Introduction

In the entrepreneurial world, a business plan stands as a testament to a company’s vision, objectives, and strategies. For any entrepreneur, whether launching a new business or scaling an existing one, crafting a comprehensive business plan is a crucial step.

This document encapsulates every facet of the business, from its product or service offerings to market analysis and financial projections. However, simply creating a plan is not the endpoint. The true value of a business plan lies in its continual evaluation and adaptation, ensuring it remains relevant and effective in an ever-evolving business landscape.

The Importance of Evaluating a Business Plan

For small business owners and entrepreneurs alike, evaluating a business plan is paramount to ensuring sustained growth and success. To evaluate a business plan means to scrutinize its contents, measure its goals against actual performance, and assess its viability in the face of market changes and competitor movements.

Regular evaluation ensures that the product or service remains competitive and meets the market’s evolving demands. Additionally, for those seeking investment, a thoroughly evaluated business plan demonstrates to potential investors the company’s commitment to adaptability and foresight.

Moreover, by periodically reviewing and adjusting the plan, entrepreneurs can identify gaps, foresee challenges, and recalibrate strategies, ensuring the business remains agile and poised for growth. In essence, to evaluate your business plan is to fortify its foundation, ensuring it guides the business towards its goals effectively and efficiently.

Understanding the Purpose of a Business Plan

At the heart of entrepreneurship lies the business plan, a crucial tool that serves multiple purposes. For anyone starting a business, the plan acts as a roadmap, detailing every step and strategy to turn the business idea into a reality.

It encompasses everything from market analysis and potential customers to financial projections and operational mechanisms. But beyond just guiding internal strategies, the business plan is also pivotal for external engagements.

Whether seeking investments, partnerships, or other collaborations, the plan provides stakeholders with a comprehensive overview, allowing them to assess the viability and potential of the project. In essence, a business plan is more than just a document; it’s a reflection of the company’s vision, ambition, and preparedness for the entrepreneurial journey ahead.

Gaining Insights into the Business Idea

Every business idea, no matter how innovative, requires thorough examination and validation. The business plan offers profound insight into the feasibility and potential of the idea. Through detailed market research, the plan identifies the target audience, their preferences, and potential gaps in the market.

Financial projections further evaluate the economic viability, providing a projection of revenues, costs, and profitability. As part of the entrepreneurship process, this deep dive into the business idea ensures that the venture stands on solid ground, ready to address market demands and challenges effectively.

Evaluating the Executive Summary

The executive summary is the introductory section of a business plan, providing a concise snapshot of the entire project. It’s often the first point of contact for potential investors or stakeholders, making its evaluation crucial. A well-crafted executive summary should encapsulate the essence of the business, from its unique value proposition and target market to its financial prospects.

Evaluating the executive summary helps determine whether the business has a clear direction, a compelling offering, and a viable strategy for growth. It sets the tone for the entire plan, ensuring that readers gain a comprehensive understanding of the business’s goals, strategies, and potential right from the outset.

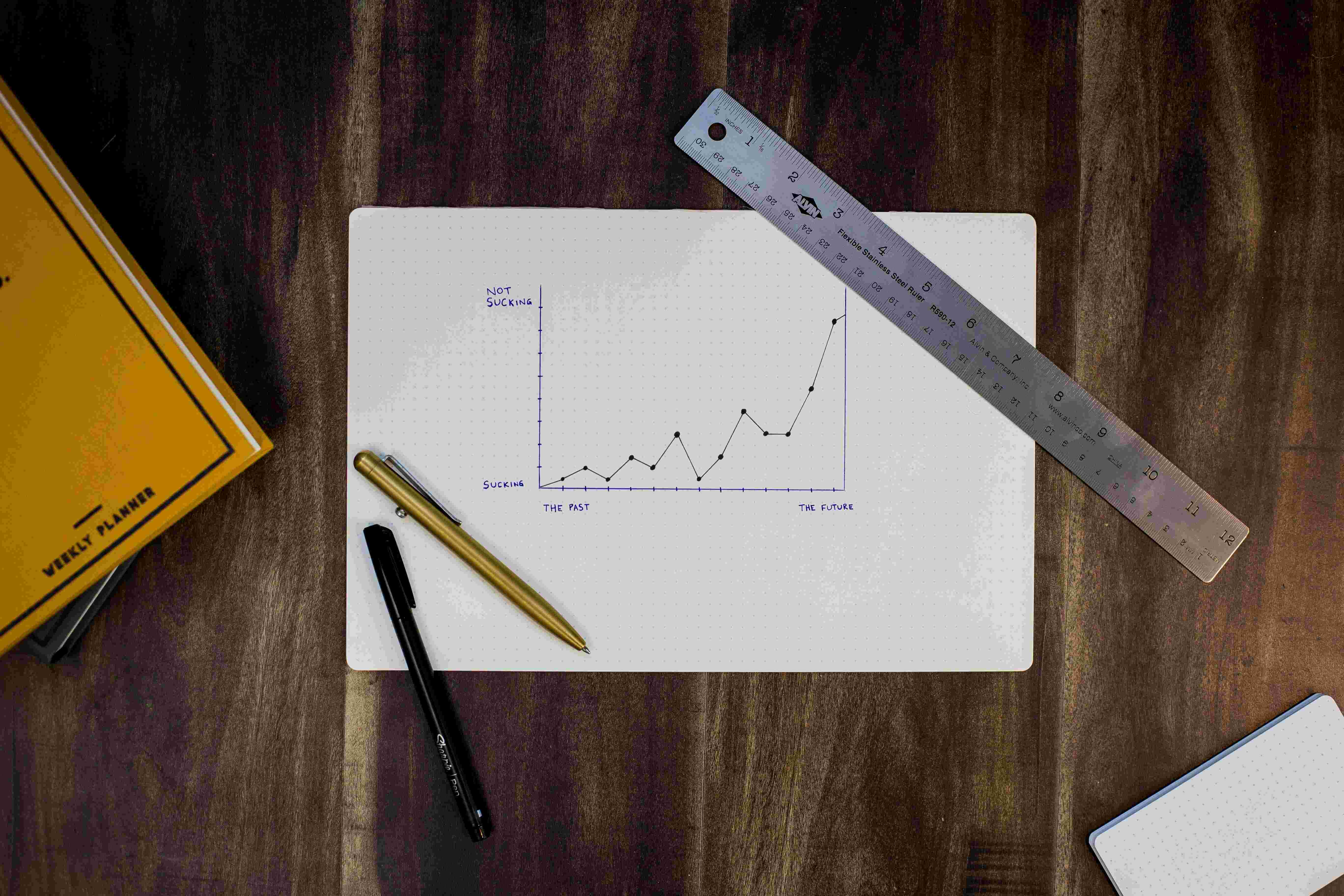

Photo by Kelly Sikkema on Unsplash

Key Factors to Consider When Evaluating a Business Plan

Market Potential and Target Audience

When evaluating a business plan, understanding the market potential is paramount. This involves assessing the marketplace’s size, growth potential, and the demand for the new product or service. It’s essential to analyze the demographics catered to, ensuring that there’s a substantial audience with a genuine need for the offering.

The business plan should provide a clear picture of the target audience, detailing their preferences, behaviors, and purchasing patterns. This information not only gauges the potential success of the product or service but also helps in tailoring marketing strategies effectively.

A well-defined target audience in the executive summary also indicates a thorough understanding of the market, a strength that can be appealing to stakeholders, including venture capital firms.

Competitive Analysis and Market Share

No business operates in isolation. Hence, a robust business plan must include a detailed competitive analysis. This section should analyze the strengths and weaknesses of competitors, their pricing strategies, and market positioning. It aids in identifying potential gaps in the marketplace that the business can capitalize on.

Furthermore, by understanding competitors, the business can differentiate itself, whether through unique features, better pricing, or exceptional service. Estimating the potential market share, given the competitive landscape, helps gauge the feasibility of the venture and its potential for growth.

Evaluating the Financial Projections

Financial projections are the heartbeat of a business plan, offering insights into the venture’s economic viability. When evaluating these projections, it’s crucial to ensure they are realistic and based on sound assumptions. Factors like projected revenue, costs, profit margins, and cash flows provide a comprehensive view of the business’s financial health.

These projections should align with the market analysis and competitive landscape, reflecting the business’s potential to capture market share and generate profits. For investors, especially venture capitalists, this section is critical. They analyze these numbers to determine the potential return on investment and the feasibility of the franchise.

Any discrepancies or over-optimistic projections can be a sign of weakness, underscoring the importance of thorough financial planning and analysis.

Questions to Ask When Evaluating a Business Plan

Market Research and Analysis Questions

When examining the market research and analysis section of a business plan, several key questions can help hone in on the venture’s viability. First, how comprehensive and current is the market data presented? Relying on outdated data or not having a broad scope can lead to miscalculations.

It’s also worthwhile to ask if third-party sources have been used to validate the research. Has the business idea been tested or surveyed among potential customers? Understanding the target audience’s demographics and preferences is crucial, so ask how detailed the customer profile is.

Lastly, how does the business differ from competitors, and is there a clear indication of a unique selling proposition?

Product or Service Questions

Evaluating the products and services section requires a deep dive into the offering’s uniqueness and demand. Key questions include: What problem does the product or service solve, and how effectively does it address customer pain points? How does it differ from existing market solutions? Is there a clear strategy to acquire and retain customers? If there are prototypes or third-party reviews, are they included in the appendix?

Financial and Operational Questions

The financial and operational sections are pivotal in assessing the business’s sustainability and growth potential. Key questions to consider are: Are the financial projections realistic, and do they align with the market analysis? How are major expenses like payroll and inventory managed?

For small business owners, is there a clear contingency plan for potential setbacks? If external funding is sought, is there a clear breakdown of its use? Finally, how scalable are the operational strategies in the face of growth?

Conclusion

A written business plan is a foundation upon which businesses build their strategies and visions. However, simply having a plan isn’t enough. The process of evaluating business plans, asking critical questions, and seeking clarity ensures that the plan is robust, viable, and poised for success.

Whether you’re a budding entrepreneur looking to create a plan or an investor in business plan development, thorough evaluation is the key to turning business aspirations into tangible successes.

Introducing School of Money

Looking to monetize your passion and skills? Dive into the School of Money – your one-stop platform for mastering the art of earning.

Whether you’re an aspiring entrepreneur, trader, or just someone keen on financial growth, our comprehensive insights on personal development, finance, and leadership are tailored for you.

Embark on a transformative journey to financial literacy and independence with School of Money and unlock your true earning potential!

Related Posts